Bringing Proven Cost Effective Solutions

Customer Centric Business Solutions

We are a digital platform provider that is committed to helping our customers take full advantage of the latest technology to streamline operations and improve service delivery.

Interfront

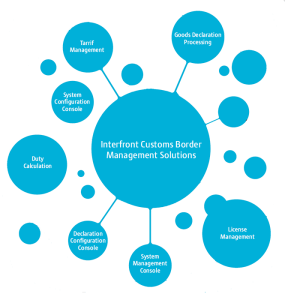

Our Products

- Goods Declaration

- Tariff Management & duty calculator

- License & certificate management

- Risk management

- Inspection and audit management

- Transit

- Excise

Cargo and goods declaration processing

The Interfront iCBS Cargo and Goods Declaration Processing modules support the business processes of the customs administration for processing of national or inter- regional goods movements. This includes the validation of documents or reported events associated with import, export, arrival and departure cargo processes. Traders and customs administrators are able to submit declarations online via the web and EDI (EDIFACT or XML) and receive instant feedback.

The Interfront iCBS Declaration Processing module replaces paper and manual controls with tactical system-based controls. This facilitates increased trade through harnessing the existing human intellectual capital to the customs operation.

The unique legislative obligations of a customs administration are supported by a powerful business rules engine employed in the iCBS Declaration Processing module. This ensures consistent implementation of the obligations of the customs administration. The implementation of the module is scalable to the size and complexities of a customs operation.

Features:

- Forms-based data representing and capture

- Aligned to the WCO data model

- Supports trusted trader (AEO) programs

- Supports seamless integration to existing systems through defined technical interfaces

- Implements protocols and conventions such as WCO SAFE and Kyoto

- Supports multiple submission channels, including web, EDI (EDIFACT and XML)

- Supports offline processing capabilities

- Real-time validation and verification of data

- Supports withdrawal, cancellation and amendment of declarations

- Supports incomplete, provisional, supplementary and periodic declarations

- Supports version control of declarations with the ability to compare changes across versions

- Resilient to network disruptions and can be customised to the specific requirements of any Customs agency

Tariff management and duty calculator

The Interfront iCBS Tariff Management Console and Duty Calculation modules conform to the WCO Harmonized Tariff system. The iCBS Tariff Management Console improves the Customs Administration business agility for promulgation to the publication of tariffs and duties.

Furthermore, the iCBS Tariff Management Console supports the Customs Administration by managing risks associated with Prohibited and Restricted goods (e.g. illicit trade) and offers the ability in maintaining the provisions for trade agreements. The Tariff Management System facilitates the management of required documentation and thus the movement towards single window.

The duty calculator ensures accurate and consistent duty calculations across the business and offers the customs organisation the flexibility to configure duty calculation formulae without requiring development. The implementation of the module is scalable to the size and complexities of a customs operation.

Features:

- Conforms to the WCO Harmonised Tariff System

- Support for national sub-heading and additional tariff notes

- Duty lookup and calculation

- Publishes tariff schedules instantly in multiple formats

- Allows changes to duty calculation formula without the need for development

- Support for maintaining trade agreement provisions.

- Manages risks and processes associated with prohibited and restricted goods

License and certificate management

The Interfront iCBS License and Certificate Management module offers a centralised, multi-agency certificate management capability for electronic permits and certificates. The Interfront iCBS License and Certificate Management module facilitates uninterrupted trade through real-time introduction of new permits and certificates. There is thus a limited need for software deployments that will impact the ongoing transactions being processed.

The scalable and integrated nature of the module supports a movement toward a single-window customs administration.

Features:

- Manage the lifecycle of permits and certificates from inception to conclusion

- Introduce new certificates or permit types in real-time without impacting ongoing processes

- Electronically manage permits and quotas and the issuance of certificates to traders

- Supports multiple submission channels including web and EDI (EDIFACT and XML)

- Resilient to network disruptions and can be customised to the specific requirements of any Customs agency

Risk management

The Interfront iCBS Risk Management module assesses the risk of non-compliance to customs laws and regulations on goods and cargo declaration transactions. The iCBS Risk Management module offers centralised rules-based risk analysis. This culminates in a module that houses self-learning and configurable risk rules based on the probability and impact of fiscal, safety and security threats. The capability of this module is extended through the measurement of trade compliance with an Authorised Economic Operators (AEO) programme.

Third-party and statistical risk analysis are implemented through the integration capability to third-party risk engines (WCO & Interpol) and the identification of trade patterns through a series of algorithms.

Inspection and audit management

The Interfront iCBS Inspection and Audit module manages the workflow tasks related to the movement of goods through integrated workflow and case management. This module supports both intrusive and non-intrusive inspection types, ranging from documentary to physical inspections.

The iCBS Inspection and Audit module supports the customs operation by preventing selective assignment or “cherry picking” of inspection cases. The implementation of the module is scalable to the size and complexities of any customs operation.

The Interfront iCBS Inspection and Audit module has gone mobile. This module supports goods inspection processes using mobile devices.

Features:

- Integrated workflow and case management

- Support for documentary or physical inspection types

- Inspections can be supported through the use of mobile technologies

- Enables a “get-next assignment” method to prevent “cherry picking” of inspection cases

- Integration with mobile devices for inspection workflow and data capturing

- Workflow is created and assigned to the relevant office, team or team member

Transit

The Interfront iCBS Transit Declaration Processing module supports the business processes of the customs administration for processing and tracking of domestic, community and international transit movements. Traders and customs administrators are able to submit declarations online via the web and EDI (EDIFACT or XML) and receive instant feedback.

The Interfront iCBS Transit Declaration Processing module replaces paper and manual controls with tactical system-based controls. This facilitates increased trade through harnessing the existing human intellectual capital to the customs operation.

The iCBS Transit Declaration Processing module can integrate into most financial systems to support the management of guarantees or bonds.

Excise

The Interfront iCBS Excise Declaration Processing modules support the business processes of the customs administration for the processing of national or inter-regional excise movements. Traders and customs administrators are able to submit declarations online via the web and EDI (EDIFACT or XML) and receive instant feedback.

The Interfront iCBS Excise Declaration Processing module replaces paper and manual controls with tactical system-based controls. This facilitates increased trade through harnessing the existing human intellectual capital to the customs operation.

The unique legislative obligations of a customs administration are supported by a powerful business rules engine employed in the iCBS Excise Declaration Processing module. This ensures consistent implementation of the obligations of the customs administration. The implementation of the module is scalable to the size and complexities of a customs operation.